Portfolios & order list

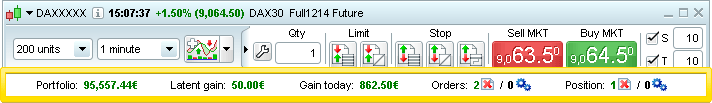

Trading information on chart

Important information related to your trading activity is displayed directly on top of your charts (such as portfolio value, today's gain, etc). For information about how to configure this, check the trading options section.

Note that the red cross icons  next to "Pending orders" and "Positions" will let you quickly close any pending orders and positions manually opened on this security.

next to "Pending orders" and "Positions" will let you quickly close any pending orders and positions manually opened on this security.

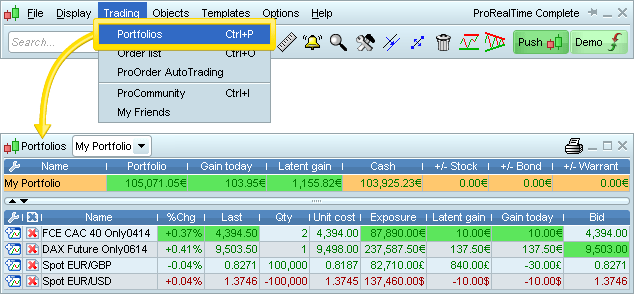

Portfolios

The Portfolios window gives an exhaustive overview of the your trading activity and lets you manage all of your open positions from one window. To open this window, select "Portfolios" from the "Trading" menu.

The Portfolios window is composed of:

- The top section showing your account number or portfolio name

- The middle section showing an overview of your performance

- The bottom section showing open positions and securities on which you executed orders during the current day

You can customize the columns to be shown in the middle section of the window. You have a choice among the following:

- Latent gain: gain or loss for currently open positions

- Gain today: gain or loss cumulated since the beginning of the current day

- +/- Security types: latent gain for different security types (ex: +/- Forex)

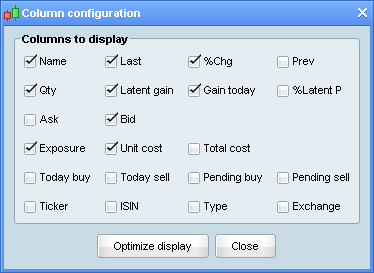

You can also customize the columns in the bottom section of the window.

The following columns are available:

- Qty: Quantity of open position

- %Latent P: Latent gain in % of the position

- Unit cost: average cost per share or contract (useful in case of pyramiding)

- Total cost: acquisition cost of the position (Quantity * Acquisition price per unit)

- Today buy: number of shares or contracts bought today

- Today sell: number of shares or contracts sold today

- Pending buy: number of shares (or contracts) awaiting to be bought

- Pending sell: number of shares (or contracts) awaiting to be sold

The gain, loss and cost figures mentioned above do not include transaction fees.

Order List

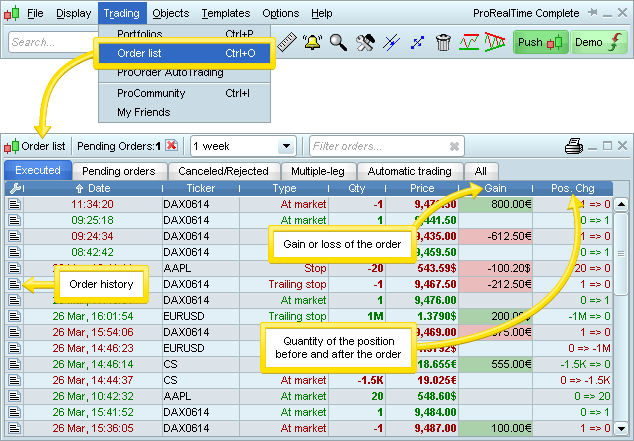

From the "Trading" menu in the main ProRealTime window, you can access the "Order List" window where you can track and manage your orders on all securities from a single window.

The window is split into different tabs which show the types of orders corresponding to their titles shown above.

The following order management tools are included in the window:

Click the red cross icon at the top of the window to cancel all pending orders or click the red cross in the line of a specific order to cancel that pending order (this icon is greyed for orders that have already been canceled or executed)

Click the red cross icon at the top of the window to cancel all pending orders or click the red cross in the line of a specific order to cancel that pending order (this icon is greyed for orders that have already been canceled or executed) Click this icon to change the price or quantity of a pending order

Click this icon to change the price or quantity of a pending order Click this icon to display the order status history

Click this icon to display the order status history or

or  : shows whether the order is server-based (open eye) or platform-based (closed eye). Platform based orders will be deleted if not executed when you exit the platform (and a warning message will be shown in this case).

: shows whether the order is server-based (open eye) or platform-based (closed eye). Platform based orders will be deleted if not executed when you exit the platform (and a warning message will be shown in this case).

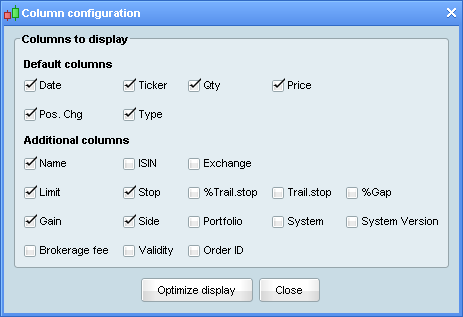

The following columns are available:

- Side: Buy or sell

- Qty: Order quantity

- Qty Exec: Quantity executed

- Price: execution price of the order or average execution price if the order was executed at multiple price levels

- Status: Order status

- Type: order type

- Gain: shows the gain or loss generated by the order if applicable

- Pos. Chg : displays the quantity of the position before and after the order. For example, if you open a new position with 100 shares "Pos. Chg" will display "0=>100".

- Limit: limit price of the order (if applicable)

- Stop: stop price of the order (if applicable)

- Trail.stop: Distance of trailing stop (in tick sizes)

- %Trail.stop: Percent of the trailing stop in % if applicable (ex: 2%)

- %Gap: %gap between order price and last price

- Order ID: ID number of the order

- Portfolio: name of the portfolio